Here’s A Quick Way To Solve A Info About How To Sell Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Stock_Option_Definition_Aug_2020-01-ba7005182cda419a883d6b140a04ef09.jpg)

A secondary marketplace connects you to investors who.

How to sell stock options. When you sell options, you want to have that. Type in the ticker symbol googl and the number of shares. Option sellers want the stock price to remain in a fairly tight trading range, or they want it to move in their favor.

One of the first things that i look for is volatility in how the stock has been trading. The overall market's expectation of volatility is captured in a metric called implied v… see more There are 15 points for picking the best stocks to sell options on.

If the next target of $150 is hit, sell all 18 with a profit of. Buying & selling contracts on the market step 1) start by immersing yourself in the world of stock options trading. With goldman sachs stock recently trading around 290, setting up a calendar spread at 290 gives the trade a neutral outlook.

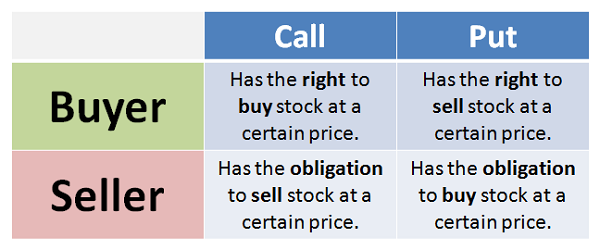

Once an option has been selected, the trader would go to the options trade ticket and enter a sell to open order to sell options. The problem is that the stock must make the desired move before expiration. Stock options refer to an agreement or contract between two parties that gives the buyer the right to buy or sell stocks or company shares at a predetermined price within a specified period of.

Call options put options depending on which you choose,. Then, he or she would make the appropriate. Step one to learning how.

Selling a naked option could also be used as an alternative to using a limit order or stop order to open an equity position. As a result, understanding the expected volatility or the rate of price fluctuations in the stock is important to an option seller. If the stock goes in the opposite.

Trading stock options is one of the most profitable ways to invest in the stock market. Instead of buying an underlying stock outright, one with sufficient cash. One of the main advantag.

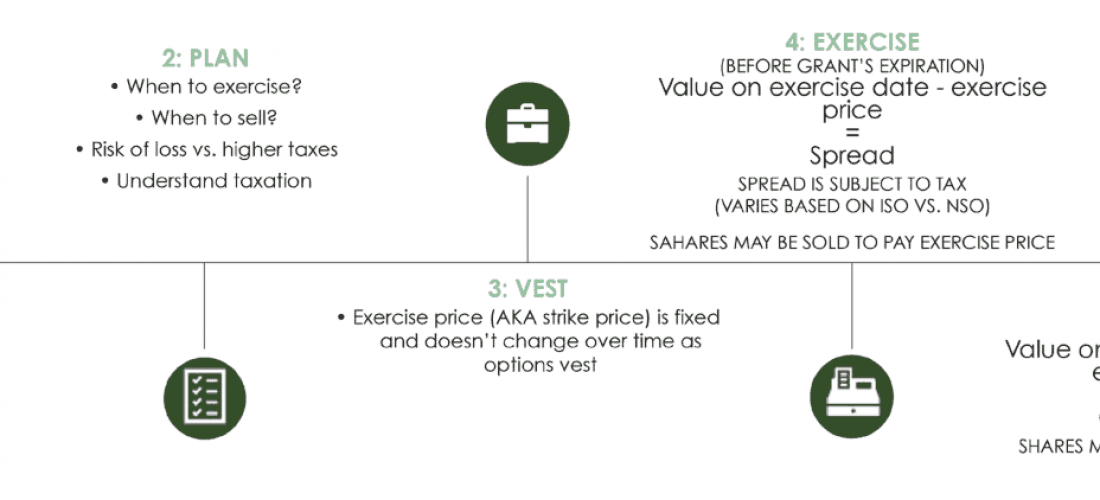

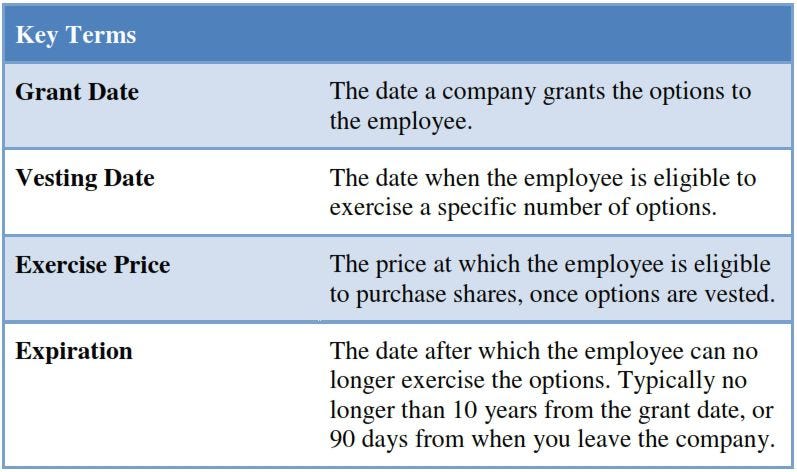

In short selling, the potential reward may be limited because most of the stock’s losses are zero, and the value of the stock can increase indefinitely while the risk is theoretically unlimited. Basically, you’re buying the option to buy or sell an underlying stock at a certain price. Once your options are vested, you have the right to buy (exercise) your company stock at a fixed price (exercise price, or strike price) at any point before the grant expires.

Therefore, a long call promises unlimited gains. Selling shares in a secondary transaction. It is also one of the riskiest strategies that could wipe out an entire.

Two ways to sell options. If the next target of $120 is hit, buy another three contracts, taking the average price to $92.22 for a total of 18 contracts. A $1 increase in the stock’s price doubles the trader’s profits because each option is worth $2.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

:max_bytes(150000):strip_icc():gifv()/stockoption_color_v1-9be9f659f9d04eeea7733d06200c5ef3.png)

:max_bytes(150000):strip_icc()/dotdash_Final_The_Ins_and_Outs_of_Selling_Options_Oct_2020-02-4a221b389aba4253b4faec37740bbda5.jpg)